The struggle is real when you’re trying to pay for cloud computing, a Netflix subscription, or that plane ticket to Rwanda. Many of us have faced the frustration of dealing with declined payments, exorbitant conversion fees, and the sheer inconvenience of navigating international transactions.

But what if there was a simpler, more efficient solution at your fingertips that lets you maintain your steeze?

Enter UPay Card – a dedicated platform that ensures secure and easy-to-use global payment services. With UPay virtual and physical cards, gone are the days of worrying about currency conversions or international transaction limits.

UPay Card: Simplified Crypto Payments for All

UPay Card simplifies global payments for all users, regardless of currency preference. Its virtual and physical cards support transactions in dollars, pounds, euros, and rands. The user-friendly app offers convenient features for on-the-go payment management, including requesting new cards, freezing existing ones, and easily loading funds onto your cards.

Online, you can use them with popular platforms like Apple Pay, Google Play, Airbnb, Uber, and eBay. In physical stores, they’re accepted at renowned brands such as Gucci, Zara, Chanel, and major food chains like Starbucks and McDonald’s.

For travellers, UPay cards provide peace of mind. Whether you’re hailing a ride, enjoying a meal, or indulging in some shopping, your UPay card will work reliably across the globe.

UPay cards also have high limits, you can pay up to 100,000 USD at once in a single transaction! This feature is particularly beneficial for users who need to make large purchases or frequent.

UPay Card Features

UPay works by letting you use your USDT to pay for goods and services, with a broad acceptance that eliminates a significant barrier for crypto holders looking to utilize their assets in everyday transactions.

Here are the features that make it standout:

Instant Spending Online and Offline: Use your digital assets instantly for purchases or global remittances, anytime and anywhere.

Multi-Currency Support: Spend in over 140+ currencies and countries without worrying about conversion issues, ideal for international travelers and digital nomads.

Low Fees: Enjoy premium services with deposit fees and transaction charges as low as 1%, low annual fees, and no cross-border fees.

Advanced Security Features: Benefit from end-to-end encryption, two-factor authentication (2FA), and strict verification checks to protect your funds and personal information.

24/7 Support: Access a dedicated customer service team available round-the-clock to resolve queries quickly, with multilingual support available.

Swift Application Process: Complete the card application in just 10 minutes for convenient and fast access to services.

Who Can Benefit from UPay Card?

UPay Card offers advantages to a wide range of users who need flexible, global payment solutions. Everyone who needs to make payment in another currency, travel to other countries and shop online stands to benefit by having a UPay card. Here’s why.

International Travelers

Business professionals, digital nomads, expatriates, and international students can use UPay Card to easily manage expenses across multiple currencies without worrying about conversion issues or high fees.

Cryptocurrency Users

Investors, traders, and blockchain enthusiasts can seamlessly convert their digital assets into real-world purchases, bridging the gap between crypto holdings and everyday transactions.

Online Shoppers

Those who frequently buy from international e-commerce platforms can enjoy hassle-free payments in various currencies, making it easier to access global markets and foreign brands.

Tech Enthusiasts

Developers, IT specialists, and startup founders can effortlessly pay for cloud computing services, SaaS subscriptions, and other tech-related expenses across borders.

Digital Marketers

Professionals managing global online advertising campaigns can streamline payments for international ad platforms and services, enhancing their ability to reach worldwide audiences.

Freelancers and Remote Workers

Self-employed individuals working with global clients can receive payments and manage finances more efficiently, regardless of their location or the currencies involved.

How to Get Started with UPay Card

UPay Card offers a user-friendly five-step process to get you started:

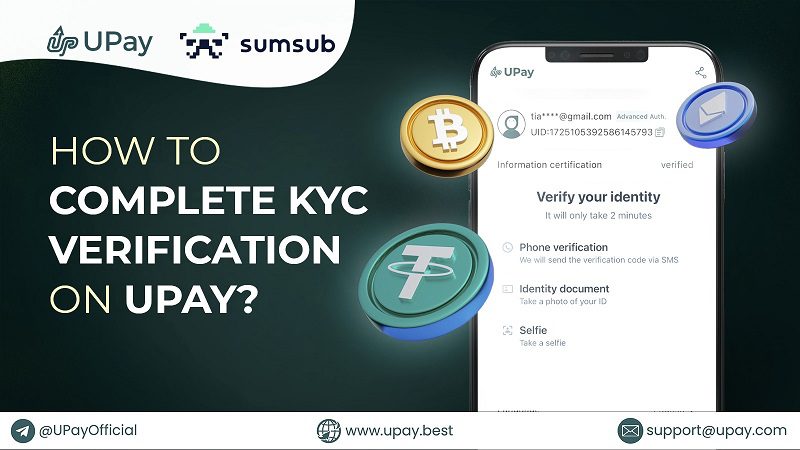

Create and Verify Your Account: Sign up on the UPay platform and provide your personal information for identity verification. This establishes your account and initiates KYC (Know Your Customer) verification.

Complete KYC Verification: UPay integrates KYC verification into the signup process. Submit the required documents to verify your identity and comply with regulations. This ensures a smooth onboarding experience.

Choose and Apply for Your Card: Once verified, browse UPay’s card offerings and select the card that best suits your needs.

Fund Your Wallet: Before applying for the physical card, deposit funds into your UPay wallet to cover any initial charges and be ready for spending.

Order Your UPay Card and Receive Details: In your UPay dashboard, click “Apply Card” to initiate the application process. Upon approval, you’ll receive your UPay card details, including the card number, expiration date, and CVV code.

The KYC verification process is built into the setup, ensuring compliance and making user onboarding smoother. Users can create an account, verify their identity, and apply for a card all on one platform, making the process simpler.

Conclusion

UPay simplifies payment for anyone struggling with international payments, currency conversions, or utilizing their cryptocurrency in everyday transactions. By bridging the gap between digital assets and real-world spending, UPay provides a versatile, secure, and user-friendly platform that caters to the needs of diverse users – from frequent travellers and crypto enthusiasts to online shoppers and remote workers.

With its high transaction limits, low fees, and widespread acceptance both online and offline, UPay Card eliminates the common frustrations associated with global payments. The straightforward five-step process ensures that users can quickly access these benefits and enjoy hassle-free transactions across 140+ countries and currencies.

Whether you’re paying for cloud computing services, booking a flight, or simply grabbing a coffee while travelling abroad, UPay Card offers the flexibility and convenience you need. It’s more than just a payment card; it’s your gateway to seamless global transactions.

Take control of your international payments and crypto spending today with UPay Card – your passport to financial freedom.

See also: Top performing crypto cards in Nigeria

The struggle is real when you’re trying to pay for cloud computing, a Netflix subscription, or that plane ticket to Rwanda. Many of us have faced the frustration of dealing with declined payments, exorbitant conversion fees, and the sheer inconvenience of navigating international transactions.

But what if there was a simpler, more efficient solution at your fingertips that lets you maintain your steeze?

Enter UPay Card – a dedicated platform that ensures secure and easy-to-use global payment services. With UPay virtual and physical cards, gone are the days of worrying about currency conversions or international transaction limits.

UPay Card: Simplified Crypto Payments for All

UPay Card simplifies global payments for all users, regardless of currency preference. Its virtual and physical cards support transactions in dollars, pounds, euros, and rands. The user-friendly app offers convenient features for on-the-go payment management, including requesting new cards, freezing existing ones, and easily loading funds onto your cards.

Online, you can use them with popular platforms like Apple Pay, Google Play, Airbnb, Uber, and eBay. In physical stores, they’re accepted at renowned brands such as Gucci, Zara, Chanel, and major food chains like Starbucks and McDonald’s.

For travellers, UPay cards provide peace of mind. Whether you’re hailing a ride, enjoying a meal, or indulging in some shopping, your UPay card will work reliably across the globe.

UPay cards also have high limits, you can pay up to 100,000 USD at once in a single transaction! This feature is particularly beneficial for users who need to make large purchases or frequent.

UPay Card Features

UPay works by letting you use your USDT to pay for goods and services, with a broad acceptance that eliminates a significant barrier for crypto holders looking to utilize their assets in everyday transactions.

Here are the features that make it standout:

Instant Spending Online and Offline: Use your digital assets instantly for purchases or global remittances, anytime and anywhere.

Multi-Currency Support: Spend in over 140+ currencies and countries without worrying about conversion issues, ideal for international travelers and digital nomads.

Low Fees: Enjoy premium services with deposit fees and transaction charges as low as 1%, low annual fees, and no cross-border fees.

Advanced Security Features: Benefit from end-to-end encryption, two-factor authentication (2FA), and strict verification checks to protect your funds and personal information.

24/7 Support: Access a dedicated customer service team available round-the-clock to resolve queries quickly, with multilingual support available.

Swift Application Process: Complete the card application in just 10 minutes for convenient and fast access to services.

Who Can Benefit from UPay Card?

UPay Card offers advantages to a wide range of users who need flexible, global payment solutions. Everyone who needs to make payment in another currency, travel to other countries and shop online stands to benefit by having a UPay card. Here’s why.

International Travelers

Business professionals, digital nomads, expatriates, and international students can use UPay Card to easily manage expenses across multiple currencies without worrying about conversion issues or high fees.

Cryptocurrency Users

Investors, traders, and blockchain enthusiasts can seamlessly convert their digital assets into real-world purchases, bridging the gap between crypto holdings and everyday transactions.

Online Shoppers

Those who frequently buy from international e-commerce platforms can enjoy hassle-free payments in various currencies, making it easier to access global markets and foreign brands.

Tech Enthusiasts

Developers, IT specialists, and startup founders can effortlessly pay for cloud computing services, SaaS subscriptions, and other tech-related expenses across borders.

Digital Marketers

Professionals managing global online advertising campaigns can streamline payments for international ad platforms and services, enhancing their ability to reach worldwide audiences.

Freelancers and Remote Workers

Self-employed individuals working with global clients can receive payments and manage finances more efficiently, regardless of their location or the currencies involved.

How to Get Started with UPay Card

UPay Card offers a user-friendly five-step process to get you started:

Create and Verify Your Account: Sign up on the UPay platform and provide your personal information for identity verification. This establishes your account and initiates KYC (Know Your Customer) verification.

Complete KYC Verification: UPay integrates KYC verification into the signup process. Submit the required documents to verify your identity and comply with regulations. This ensures a smooth onboarding experience.

Choose and Apply for Your Card: Once verified, browse UPay’s card offerings and select the card that best suits your needs.

Fund Your Wallet: Before applying for the physical card, deposit funds into your UPay wallet to cover any initial charges and be ready for spending.

Order Your UPay Card and Receive Details: In your UPay dashboard, click “Apply Card” to initiate the application process. Upon approval, you’ll receive your UPay card details, including the card number, expiration date, and CVV code.

The KYC verification process is built into the setup, ensuring compliance and making user onboarding smoother. Users can create an account, verify their identity, and apply for a card all on one platform, making the process simpler.

Conclusion

UPay simplifies payment for anyone struggling with international payments, currency conversions, or utilizing their cryptocurrency in everyday transactions. By bridging the gap between digital assets and real-world spending, UPay provides a versatile, secure, and user-friendly platform that caters to the needs of diverse users – from frequent travellers and crypto enthusiasts to online shoppers and remote workers.

With its high transaction limits, low fees, and widespread acceptance both online and offline, UPay Card eliminates the common frustrations associated with global payments. The straightforward five-step process ensures that users can quickly access these benefits and enjoy hassle-free transactions across 140+ countries and currencies.

Whether you’re paying for cloud computing services, booking a flight, or simply grabbing a coffee while travelling abroad, UPay Card offers the flexibility and convenience you need. It’s more than just a payment card; it’s your gateway to seamless global transactions.

Take control of your international payments and crypto spending today with UPay Card – your passport to financial freedom.

See also: Top performing crypto cards in Nigeria

UPay Card simplifies global payments for all users, regardless of currency preference

The struggle is real when you’re trying to pay for cloud computing, a Netflix subscription, or that plane ticket to Rwanda. Many of us have faced the frustration of dealing with declined payments, exorbitant conversion fees, and the sheer inconvenience of navigating international transactions.

But what if there was a simpler, more efficient solution at your fingertips that lets you maintain your steeze?

Enter UPay Card – a dedicated platform that ensures secure and easy-to-use global payment services. With UPay virtual and physical cards, gone are the days of worrying about currency conversions or international transaction limits.

UPay Card: Simplified Crypto Payments for All

UPay Card simplifies global payments for all users, regardless of currency preference. Its virtual and physical cards support transactions in dollars, pounds, euros, and rands. The user-friendly app offers convenient features for on-the-go payment management, including requesting new cards, freezing existing ones, and easily loading funds onto your cards.

Online, you can use them with popular platforms like Apple Pay, Google Play, Airbnb, Uber, and eBay. In physical stores, they’re accepted at renowned brands such as Gucci, Zara, Chanel, and major food chains like Starbucks and McDonald’s.

For travellers, UPay cards provide peace of mind. Whether you’re hailing a ride, enjoying a meal, or indulging in some shopping, your UPay card will work reliably across the globe.

UPay cards also have high limits, you can pay up to 100,000 USD at once in a single transaction! This feature is particularly beneficial for users who need to make large purchases or frequent.

UPay Card Features

UPay works by letting you use your USDT to pay for goods and services, with a broad acceptance that eliminates a significant barrier for crypto holders looking to utilize their assets in everyday transactions.

Here are the features that make it standout:

Instant Spending Online and Offline: Use your digital assets instantly for purchases or global remittances, anytime and anywhere.

Multi-Currency Support: Spend in over 140+ currencies and countries without worrying about conversion issues, ideal for international travelers and digital nomads.

Low Fees: Enjoy premium services with deposit fees and transaction charges as low as 1%, low annual fees, and no cross-border fees.

Advanced Security Features: Benefit from end-to-end encryption, two-factor authentication (2FA), and strict verification checks to protect your funds and personal information.

24/7 Support: Access a dedicated customer service team available round-the-clock to resolve queries quickly, with multilingual support available.

Swift Application Process: Complete the card application in just 10 minutes for convenient and fast access to services.

Who Can Benefit from UPay Card?

UPay Card offers advantages to a wide range of users who need flexible, global payment solutions. Everyone who needs to make payment in another currency, travel to other countries and shop online stands to benefit by having a UPay card. Here’s why.

International Travelers

Business professionals, digital nomads, expatriates, and international students can use UPay Card to easily manage expenses across multiple currencies without worrying about conversion issues or high fees.

Cryptocurrency Users

Investors, traders, and blockchain enthusiasts can seamlessly convert their digital assets into real-world purchases, bridging the gap between crypto holdings and everyday transactions.

Online Shoppers

Those who frequently buy from international e-commerce platforms can enjoy hassle-free payments in various currencies, making it easier to access global markets and foreign brands.

Tech Enthusiasts

Developers, IT specialists, and startup founders can effortlessly pay for cloud computing services, SaaS subscriptions, and other tech-related expenses across borders.

Digital Marketers

Professionals managing global online advertising campaigns can streamline payments for international ad platforms and services, enhancing their ability to reach worldwide audiences.

Freelancers and Remote Workers

Self-employed individuals working with global clients can receive payments and manage finances more efficiently, regardless of their location or the currencies involved.

How to Get Started with UPay Card

UPay Card offers a user-friendly five-step process to get you started:

Create and Verify Your Account: Sign up on the UPay platform and provide your personal information for identity verification. This establishes your account and initiates KYC (Know Your Customer) verification.

Complete KYC Verification: UPay integrates KYC verification into the signup process. Submit the required documents to verify your identity and comply with regulations. This ensures a smooth onboarding experience.

Choose and Apply for Your Card: Once verified, browse UPay’s card offerings and select the card that best suits your needs.

Fund Your Wallet: Before applying for the physical card, deposit funds into your UPay wallet to cover any initial charges and be ready for spending.

Order Your UPay Card and Receive Details: In your UPay dashboard, click “Apply Card” to initiate the application process. Upon approval, you’ll receive your UPay card details, including the card number, expiration date, and CVV code.

The KYC verification process is built into the setup, ensuring compliance and making user onboarding smoother. Users can create an account, verify their identity, and apply for a card all on one platform, making the process simpler.

Conclusion

UPay simplifies payment for anyone struggling with international payments, currency conversions, or utilizing their cryptocurrency in everyday transactions. By bridging the gap between digital assets and real-world spending, UPay provides a versatile, secure, and user-friendly platform that caters to the needs of diverse users – from frequent travellers and crypto enthusiasts to online shoppers and remote workers.

With its high transaction limits, low fees, and widespread acceptance both online and offline, UPay Card eliminates the common frustrations associated with global payments. The straightforward five-step process ensures that users can quickly access these benefits and enjoy hassle-free transactions across 140+ countries and currencies.

Whether you’re paying for cloud computing services, booking a flight, or simply grabbing a coffee while travelling abroad, UPay Card offers the flexibility and convenience you need. It’s more than just a payment card; it’s your gateway to seamless global transactions.

Take control of your international payments and crypto spending today with UPay Card – your passport to financial freedom.

See also: Top performing crypto cards in Nigeria